Having up-to-date financial data is crucial for effectively running your business. A best-in-class cloud accounting system can play a pivotal role in achieving this. Unlike traditional methods where you might wait until the end of the month or year for financial updates, cloud-enabled software and mobile apps provide instant access to business performance data, allowing you to monitor progress against your business strategy in real time. This valuable insight helps you meet your business goals, grow your business, and save time to focus on what really matters.

Key Features of Cloud Accounting Solutions

-

Bank Account Integration:

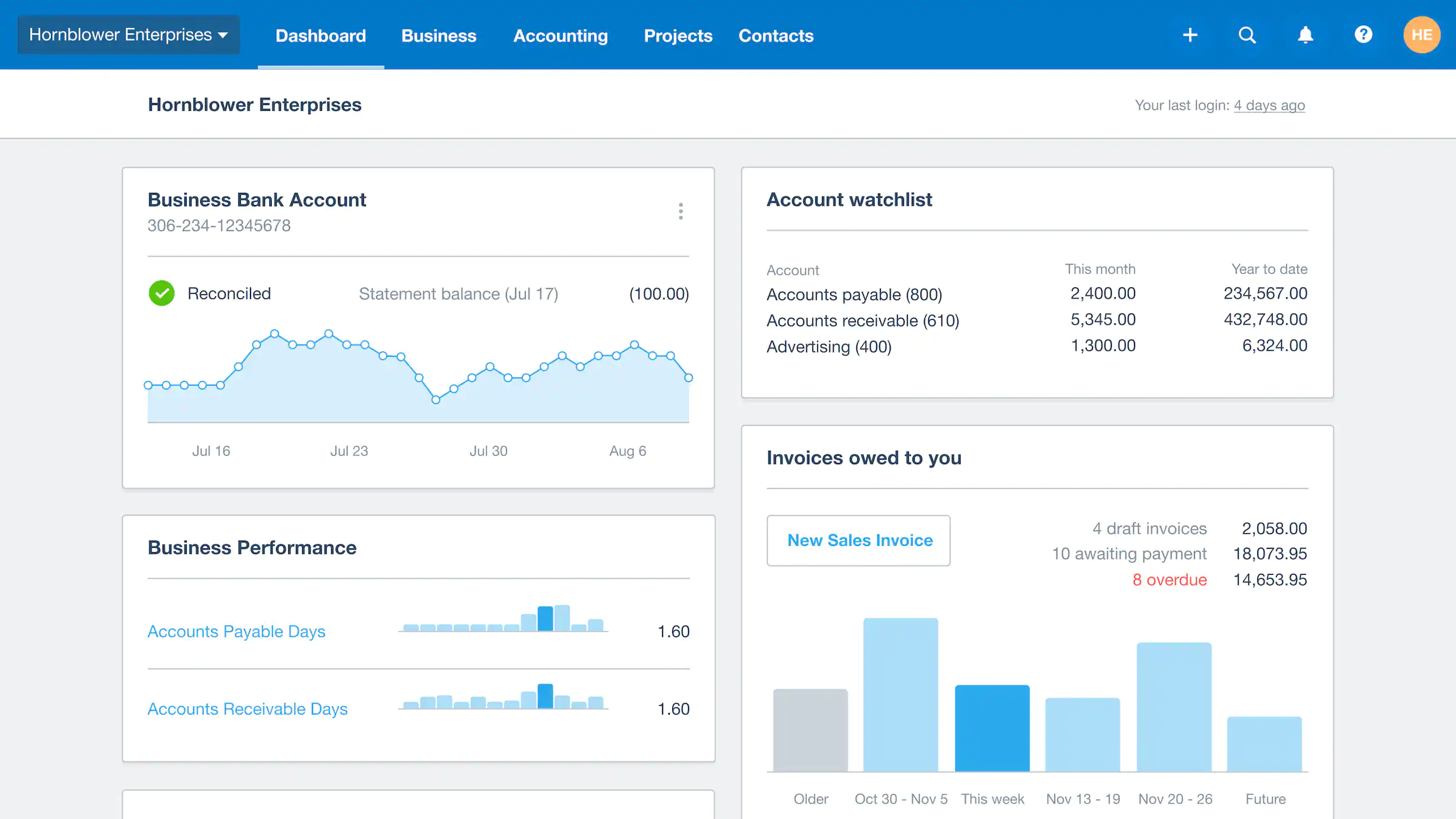

Most cloud accounting software integrates with your business bank account, allowing you to see and process bank transactions as they happen. This integration streamlines and automates your bank reconciliation process, saving time, improving accuracy, and providing an updated financial picture of your business in real time.

-

Invoice Management:

Cloud accounting solutions provide detailed reports on the invoicing process, showing when invoices were created, sent, viewed, and paid. This transparency improves customer experience and reduces the burden of chasing invoices. Cloud platforms offer various payment methods for customers, such as “click to pay” links, mobile payment apps, and open banking transfers, along with automatic reminders and chasers for due payments. Data from Xero indicates that businesses using these features get paid 14 days faster on average, alleviating cashflow issues.

-

Effective Reporting:

Cloud accounting software provides standardised and customisable financial reports in easy-to-read formats, including graphs and charts. These reports can be viewed instantaneously via apps or web browsers and allow you to drill down to the underlying transactions by simply clicking through numbers or chart elements. This functionality makes it simpler to understand what is driving the numbers, enabling you to visualise and interpret reports to identify patterns, trends, and insights for more informed decision-making. Customisable and detailed information can help link your business’s performance to your strategic goals and KPIs, highlighting areas of opportunity and improvement.

-

Cashflow Forecasting:

Cloud-based accounting software helps you stay ahead of your business’s cashflow situation. By knowing your cash reserves at certain points in the coming weeks and months, you can plan ahead and ensure your business has necessary contingency plans in place. Cloud accounting systems include basic cashflow forecasting tools, which can be enhanced with add-on cashflow forecasting and management apps. This makes it easier and more cost-effective to manage cashflow worries and maintain control of your business.

We Are Here to Help

- If you have any questions about implementing cloud accounting software solutions or maximising the features they offer, please get in touch with a member of our specialist xero team or your trusted VPC advisor.